AI Engines Ask-Answer-Action

Leadership

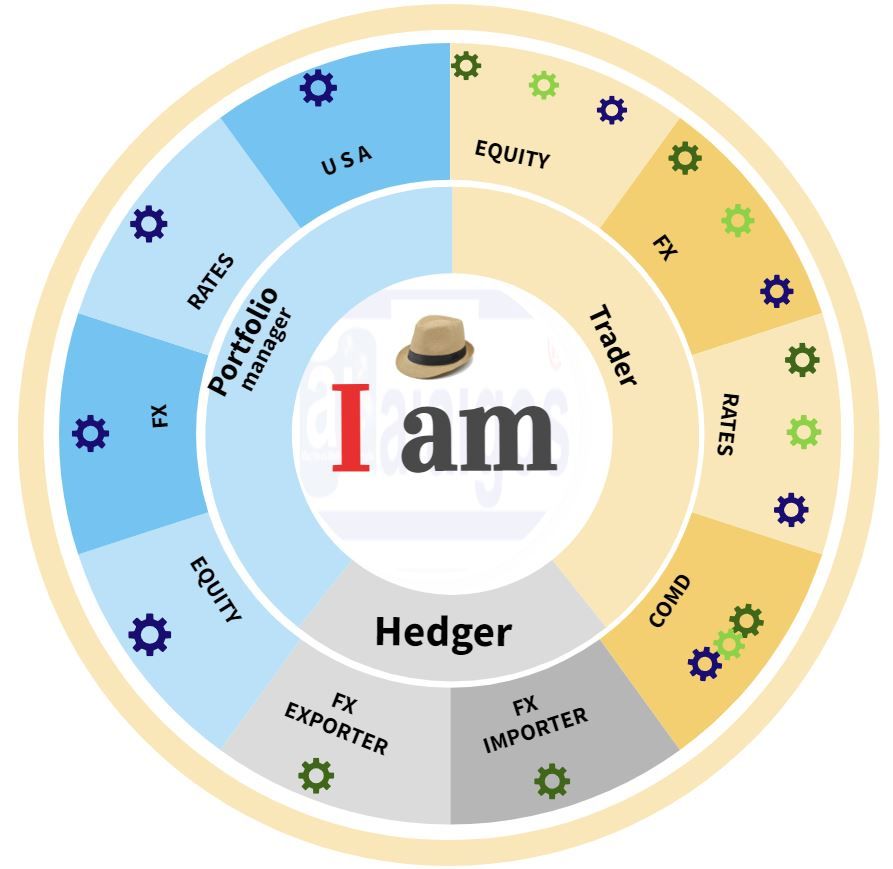

W A L K THROUGHUnderstand anatomy of odds, idiosyncrasies of domain problem .and. design imperatives of solution drivers with application in 20 Use-cases across Markets. Get soundbites of our customer speak. Get Live Market Opportunity-scoreboard on Man x Machine mode or ZERO-Human mode.

Traders Multiplier

Multiply Trader value add in man-machine mode. Start with 0.25 Million ways to better your Risk-Money-Capital decisions;add more.

Result: Risk-Reward beyond human intelligence

Strategy

Strategy Odds beats Market Odds

Strategy

Better Your Strategy Risk-Rewards

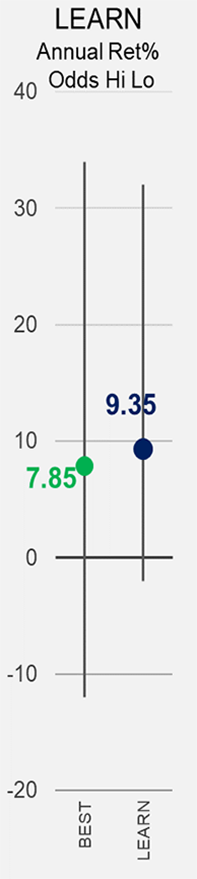

Risk

MANAGEMENT

Decision – Problem

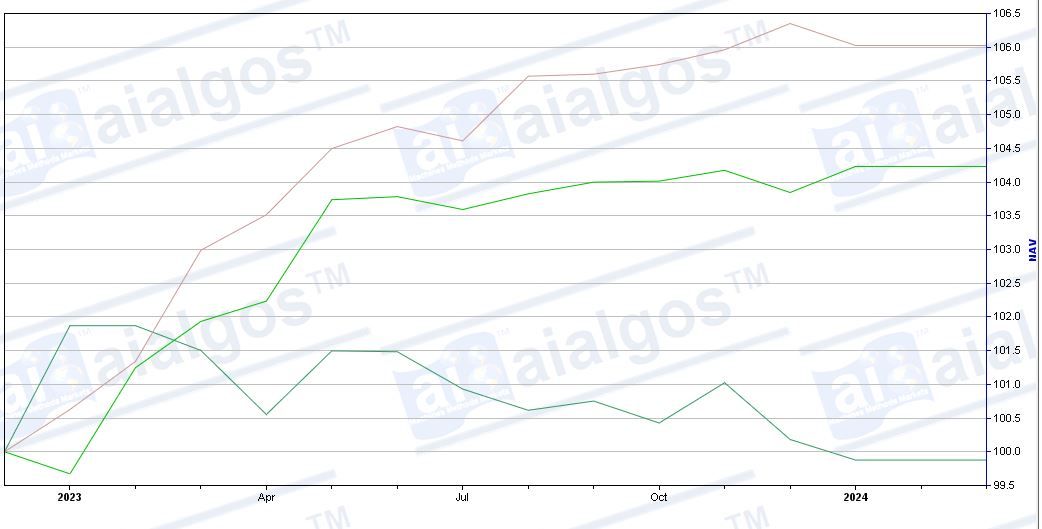

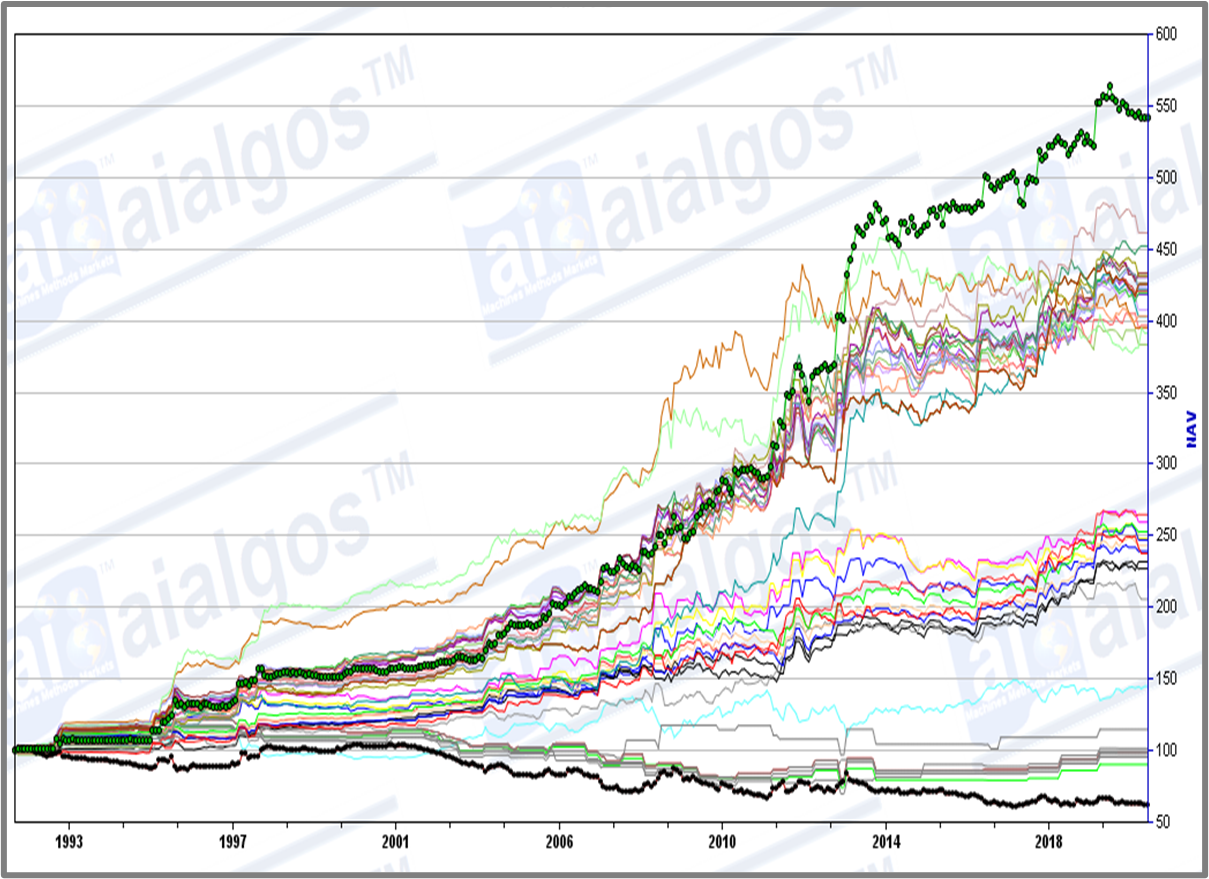

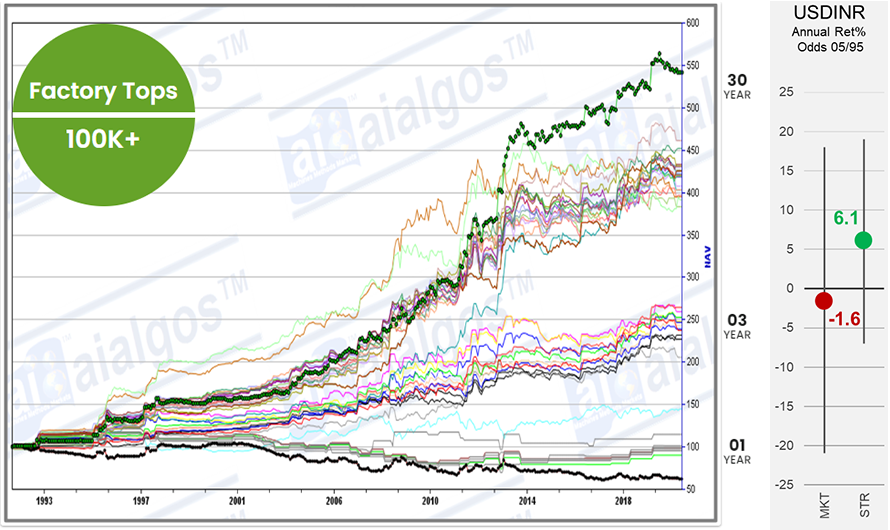

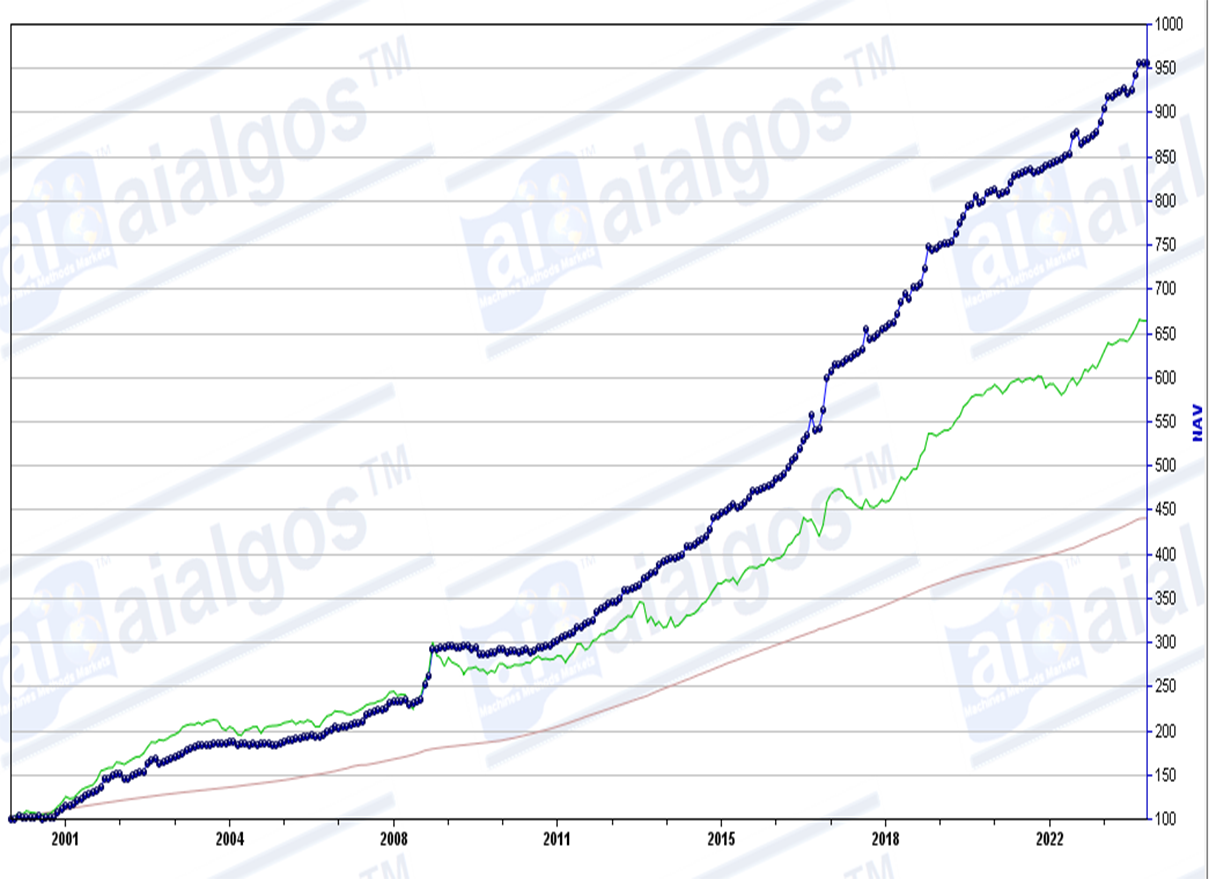

What are (1) comparative NAVS Market vs Strategies(2)Odds(5-95) of Annual Returns (3) Factory Tops of 100 K for last Full History, 3 Years, 1 Year

Decision – Support

Get Classified Factory-Tops of 100K+ Strategies Selection ready for machine-lenses.Strategy pendulum has better odds than Market

Risk-Reward

| NAV | DD | G/L |

|---|---|---|

| 542 | -7 | 1.8 |

| 62 | -42 | 0.9 |

Alpha

Better Your Strategy Risk-Rewards

Alpha

Better Your Strategy Risk-Rewards

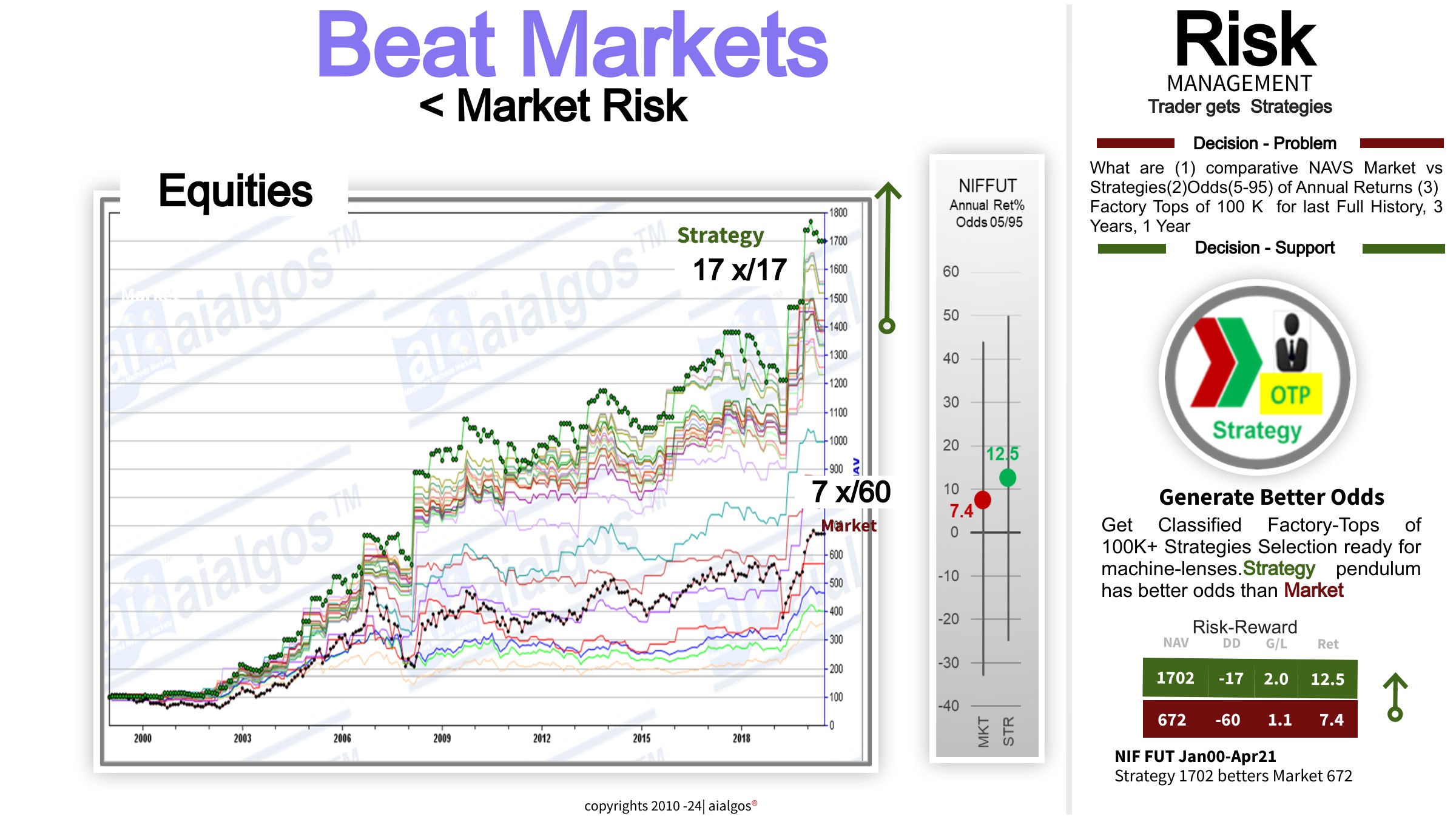

Money

MANAGEMENT

Decision – Problem

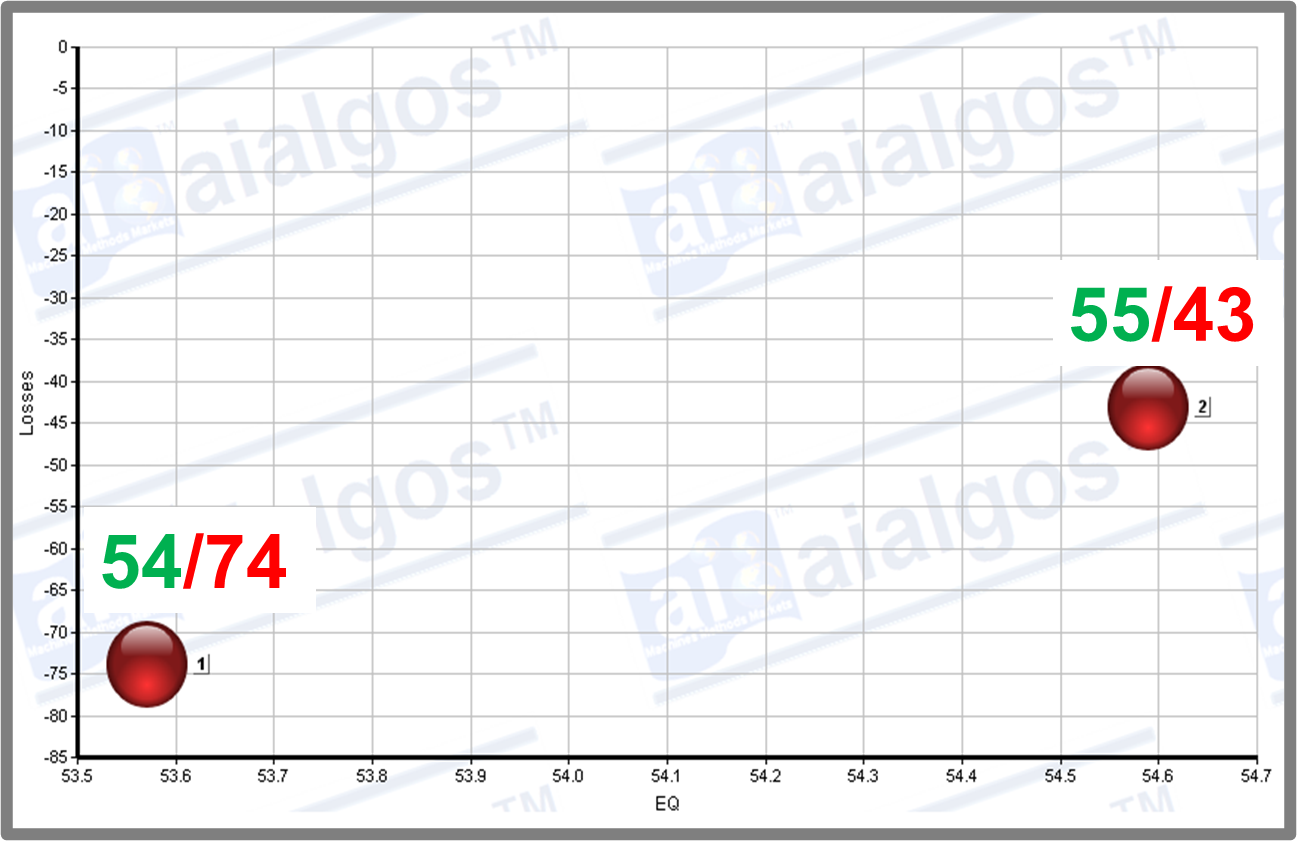

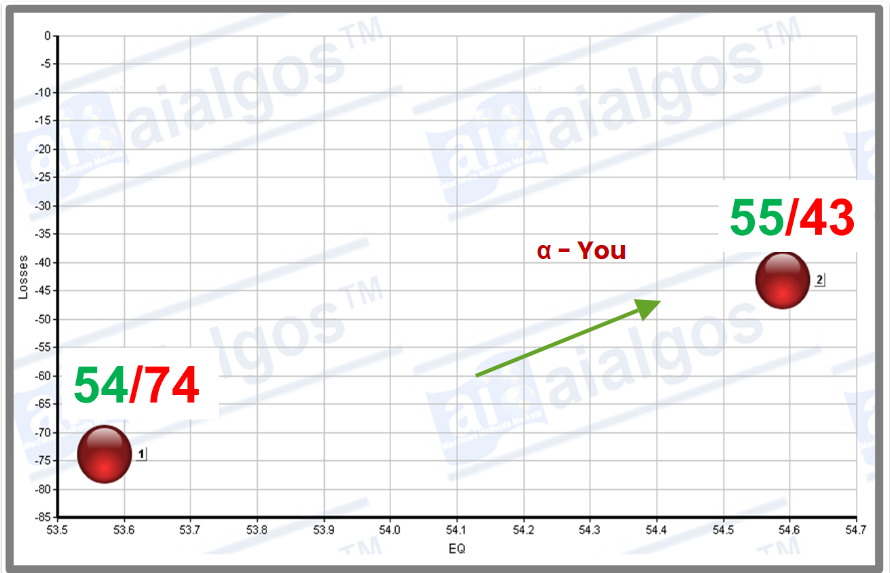

WITHOUT changing my strategy can alpha improve its risk reward

Decision – Support

I trade My-Favorite-Strategy. Can-AI improve the risk-rewards of my strategy without changing it?

Risk-Reward

| P&L | Loss | G/L |

|---|---|---|

| 55 | 46 | 2.3 |

| 54 | 74 | 1.7 |

Learning

Better your Best

Learning

Better your Best

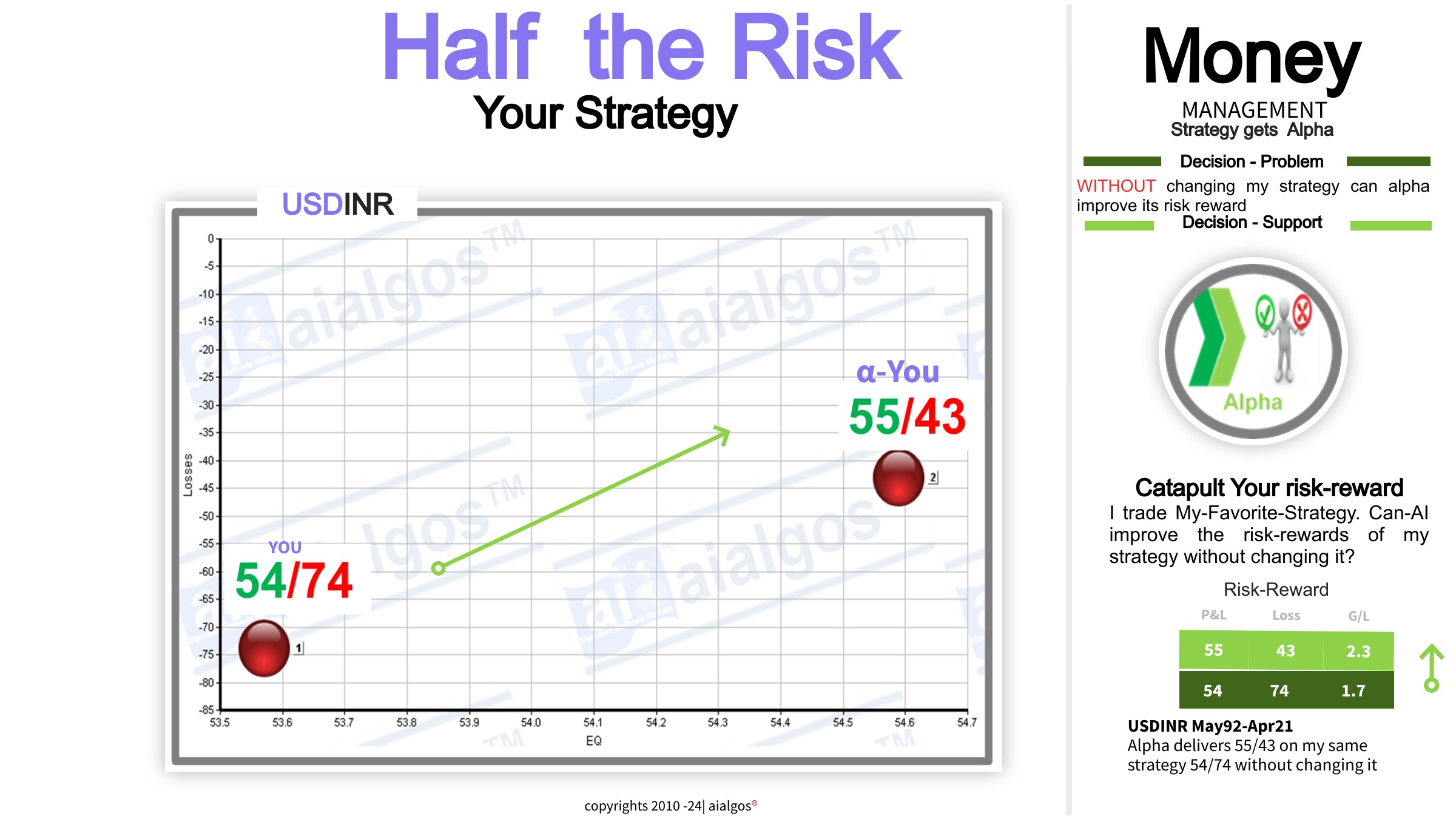

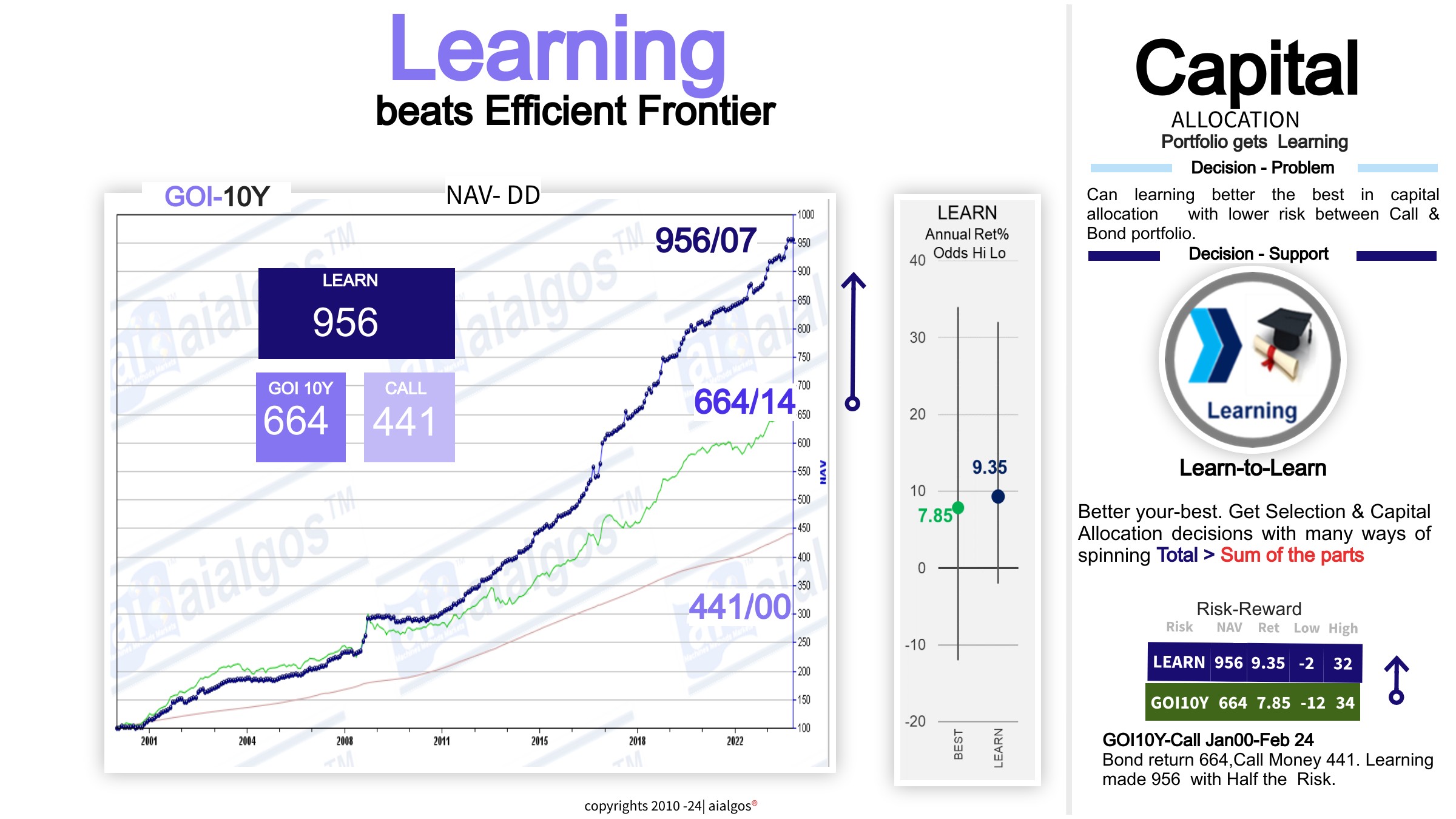

Capital

ALLOCATION

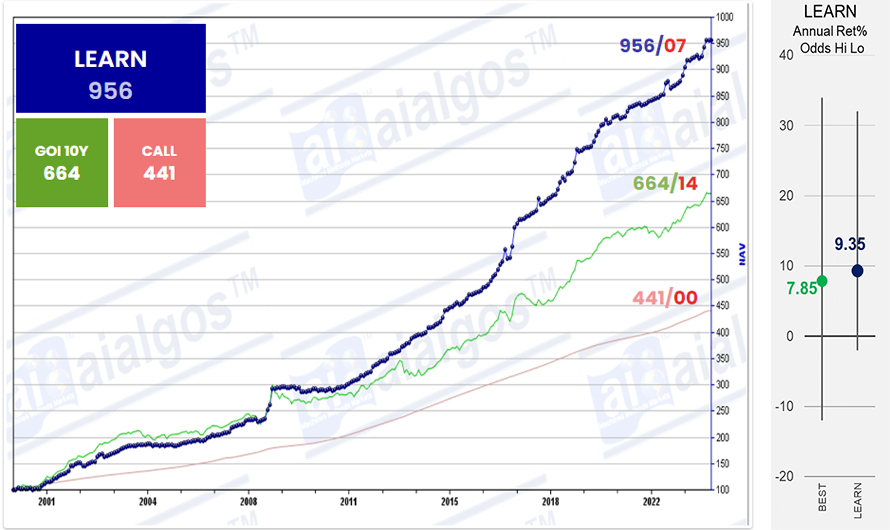

Decision – Problem

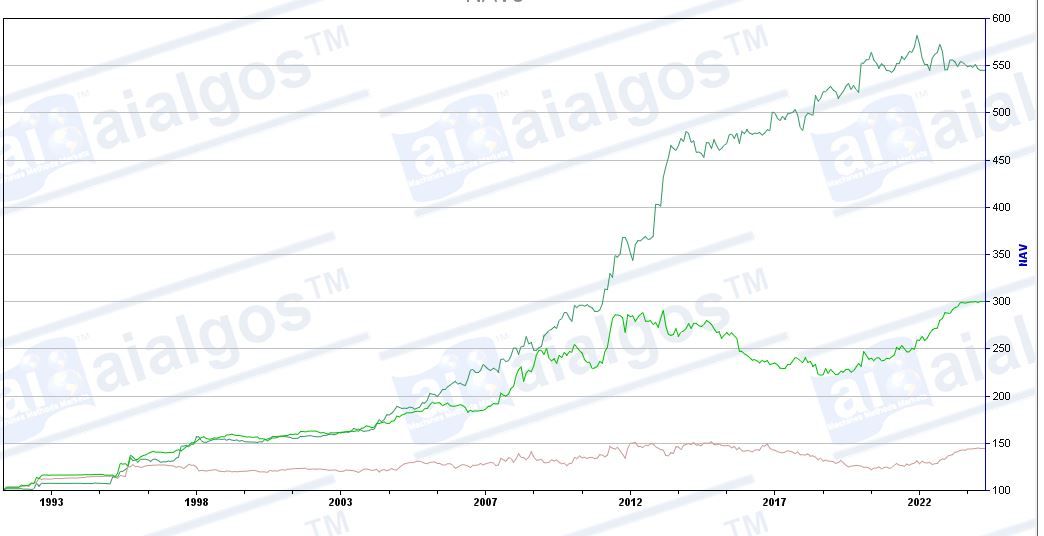

Can learning better the best in capital allocation with lower risk between Call & Bond portfolio.

Decision – Support

Better your-best. Get Selection & Capital Allocation decisions with many ways of spinning Total > Sum of the parts

Risk-Reward

| Risk | NAV | Ret | Low | High |

|---|---|---|---|---|

| LEARN | 956 | 9.35 | -2 | 32 |

| GOI10Y | 664 | 7.85 | -12 | 34 |

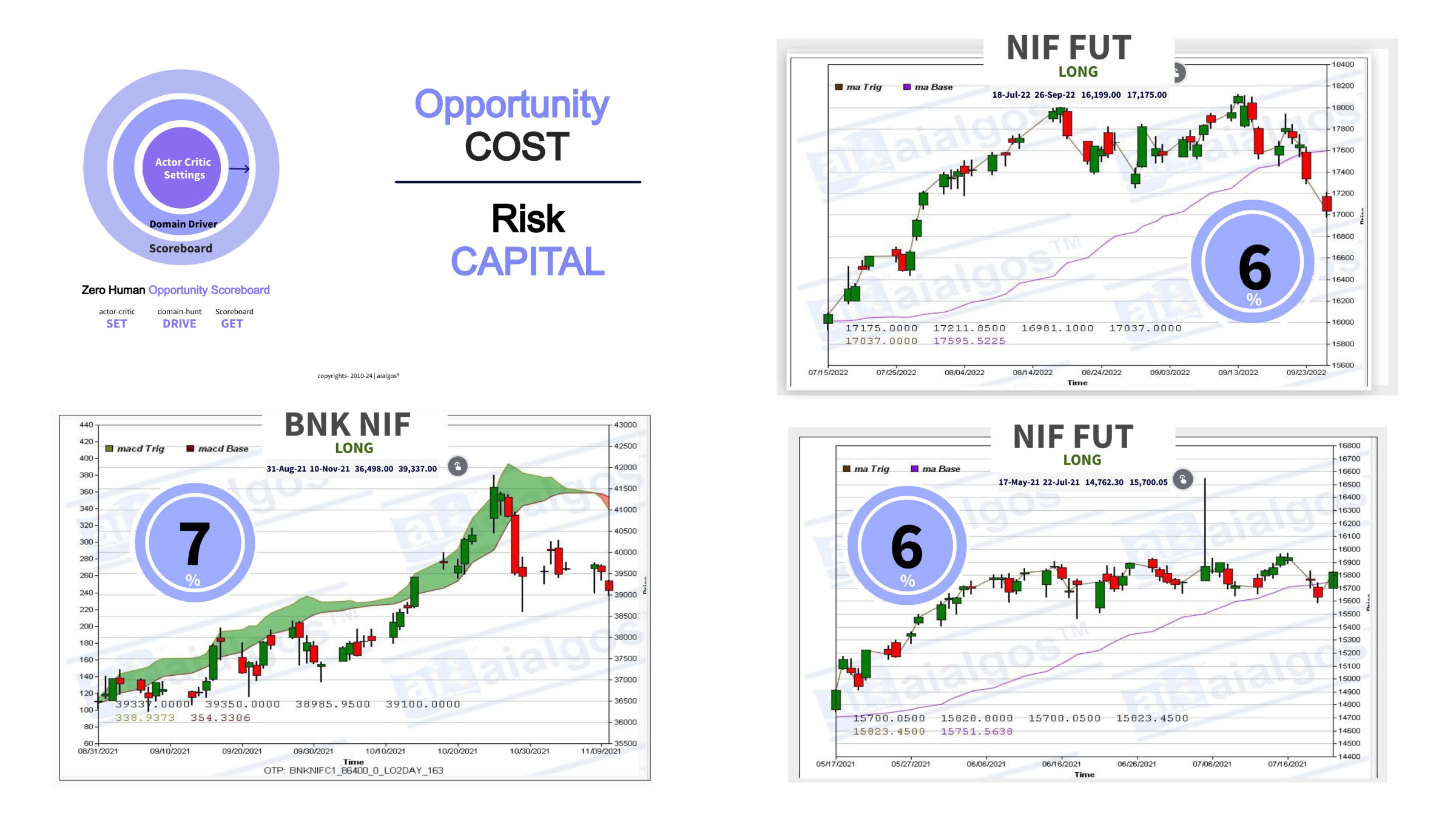

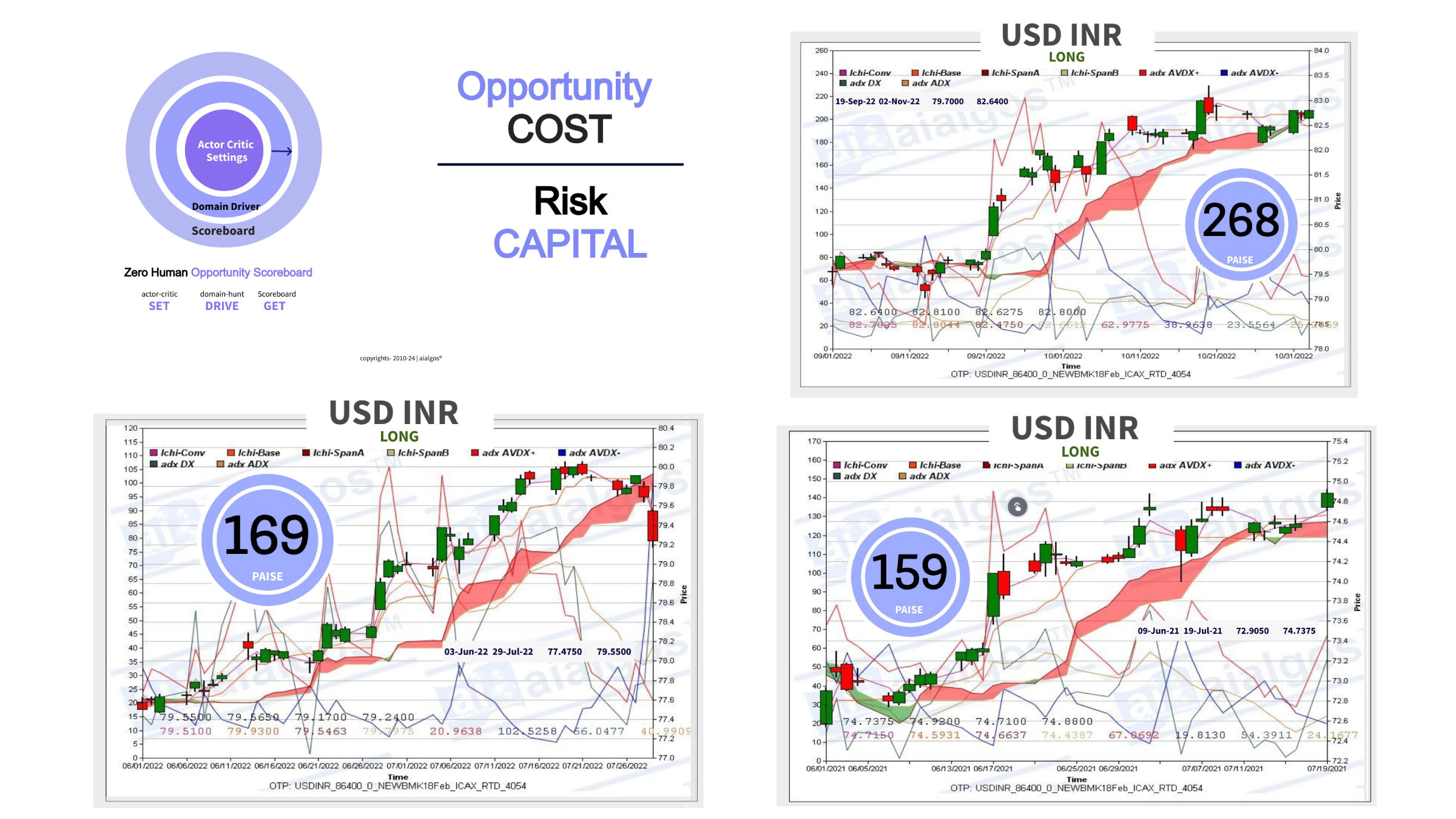

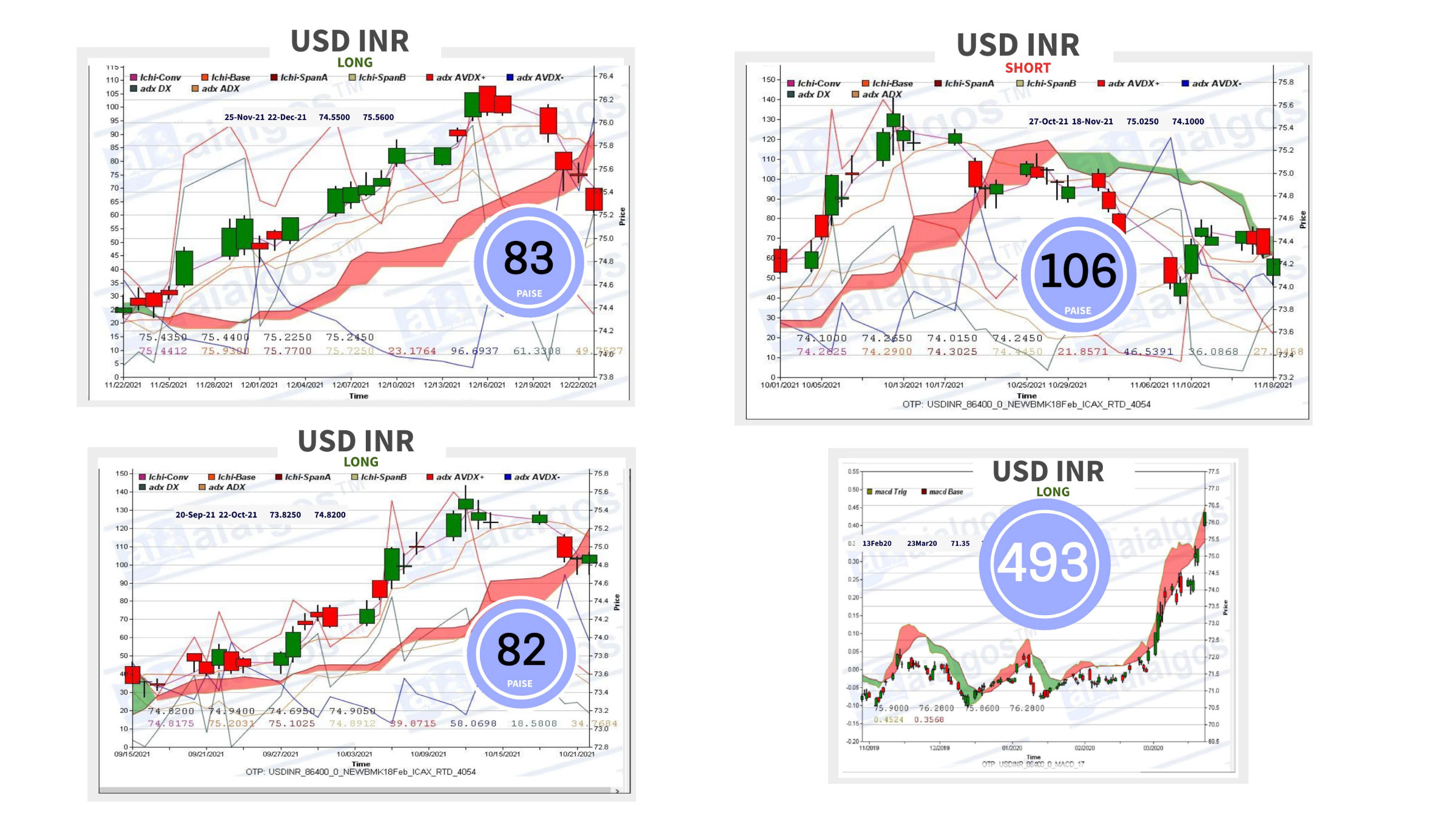

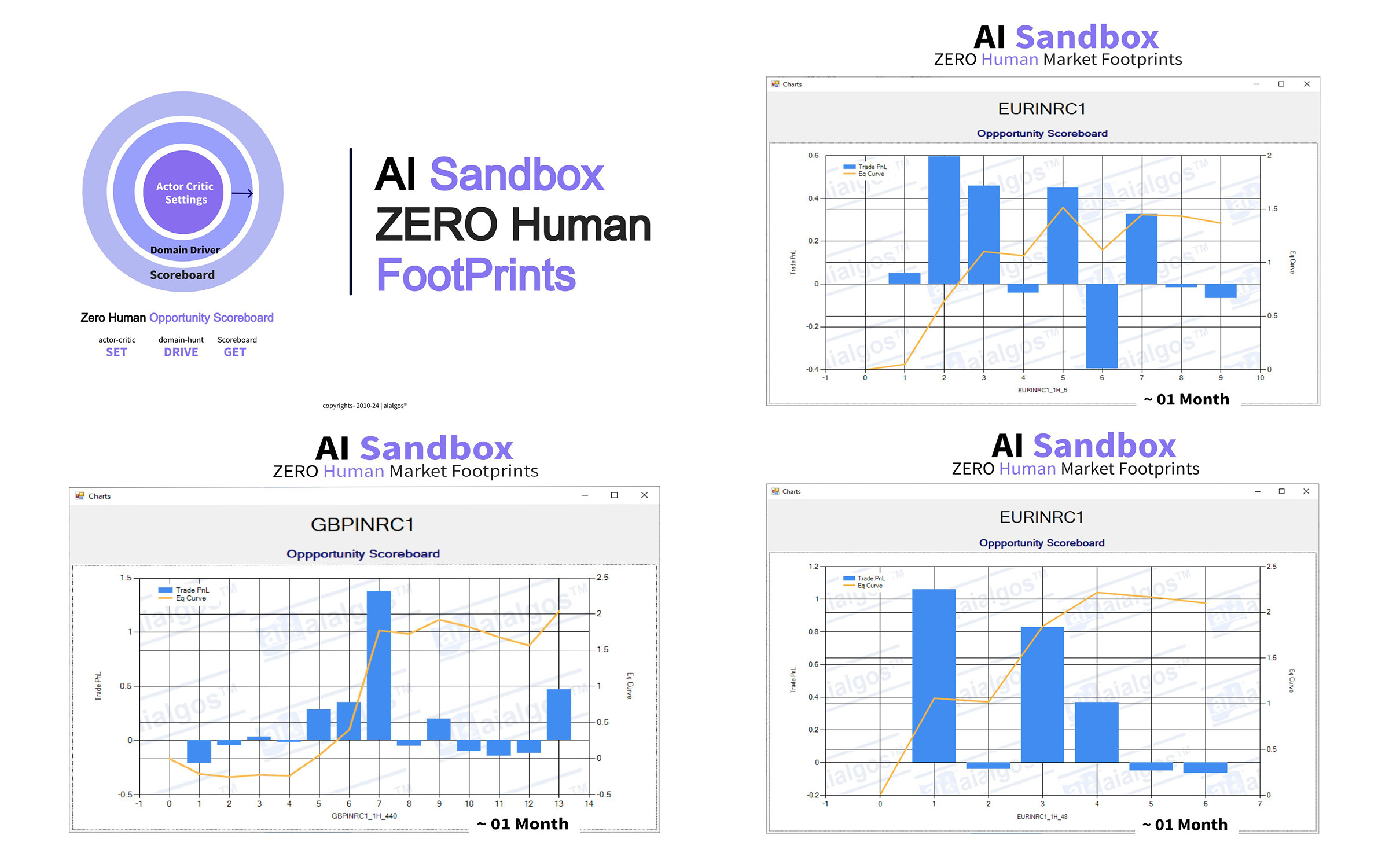

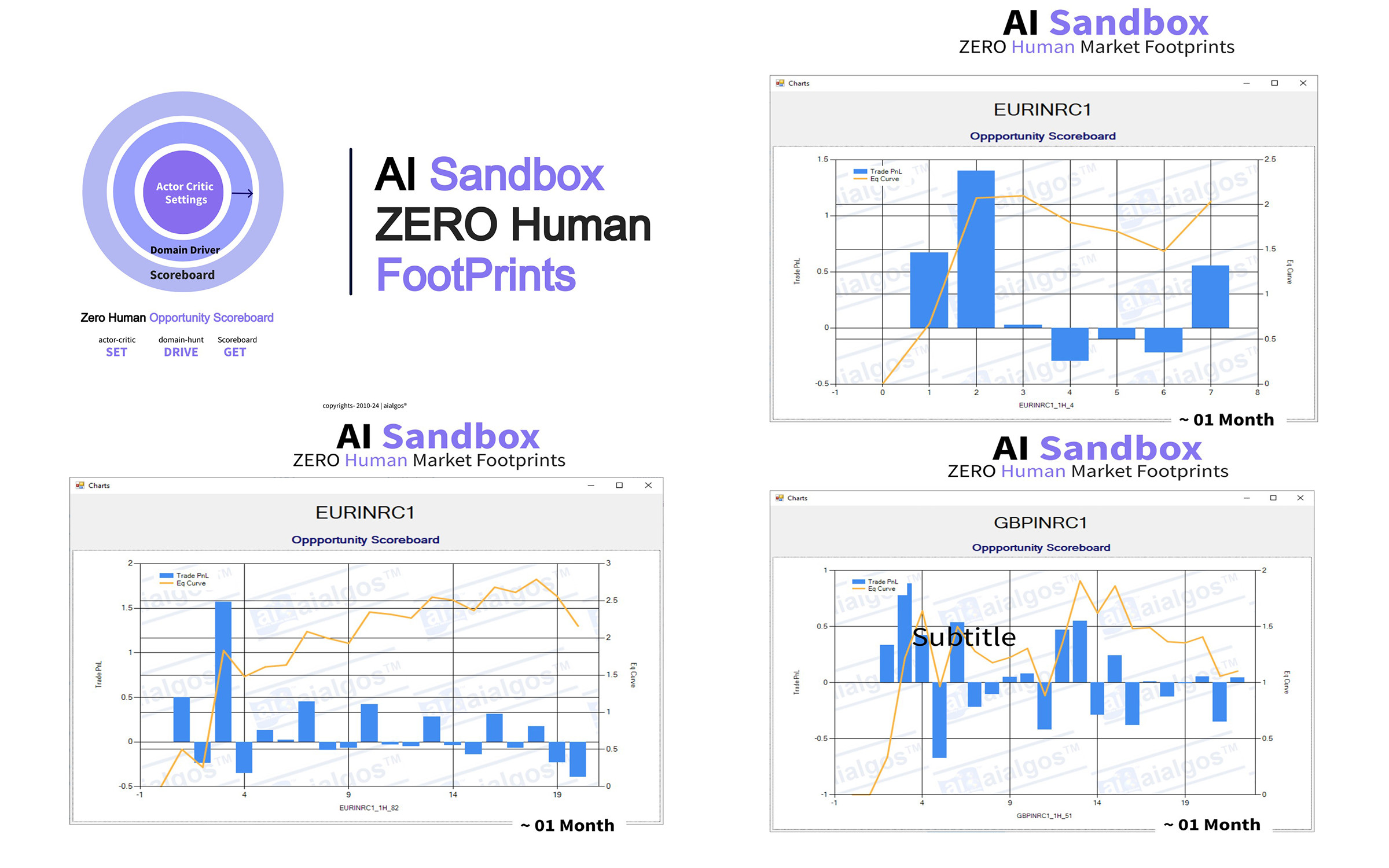

Opportunity Scoreboard

Get Hunted Opportunity out of Potential. Get Opportunity Scoreboard live with Zero Human

How Practised

Result: Hunted Opportunities from Potential Opportunities

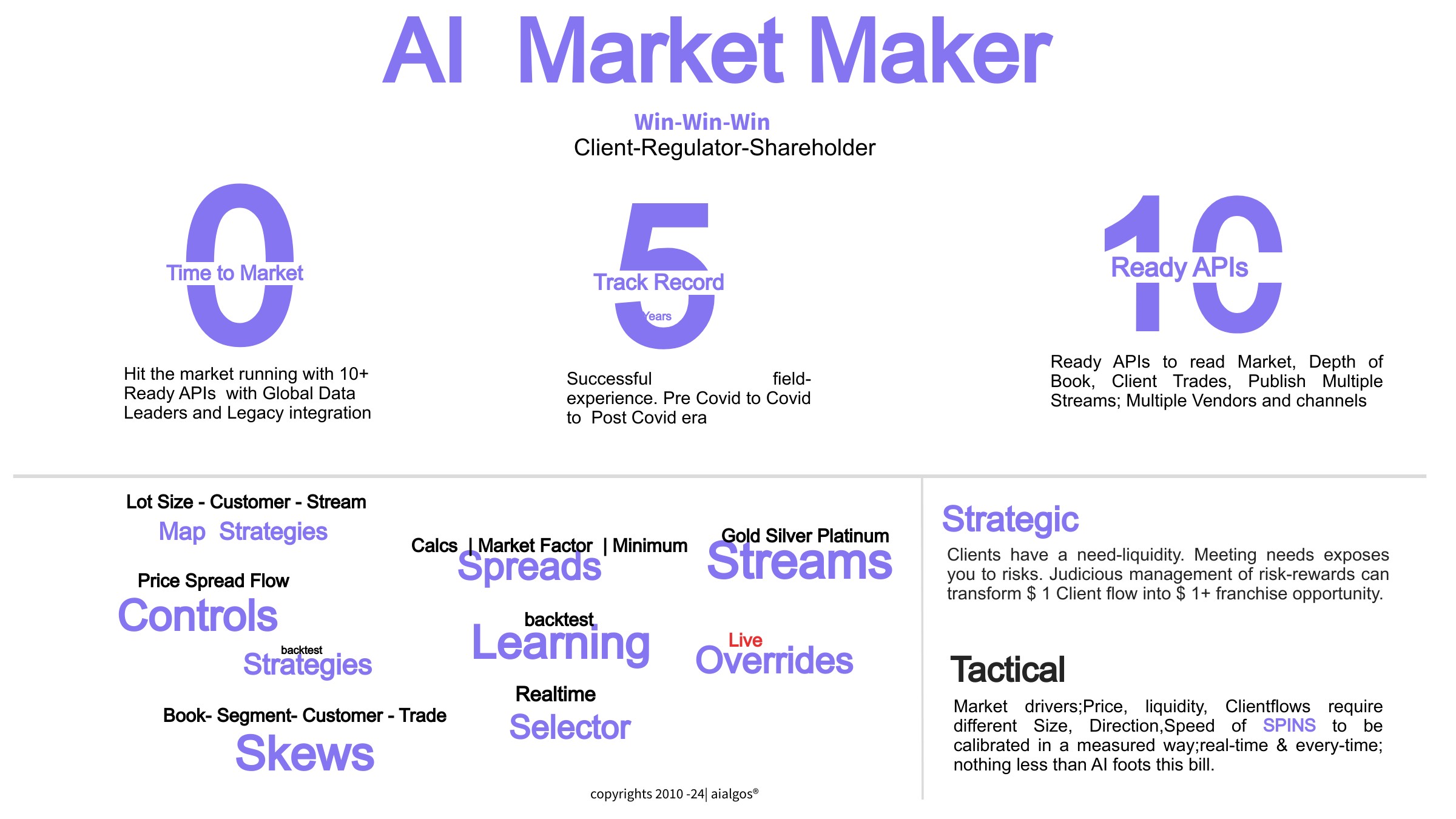

AI Market Maker

Judicious risk-management transforms 1$ client flow into 1$+ franchise opportunity.

Result: Better Origination Better Cover

Customer speak

Manager Pvt Bank

We have been associated with AI Algos for many years and have seen its evolution to its current form which is a complete offering in every sense. The add ons desired by the traders in the past was smoothly delivered by AI Algos. The system ticks all the relevant aspects valued in a quality Decision-Support system.

Manager Pvt Bank

AI algos has provided a platform to identify and generate trade signals using system intelligence; thus, helping to approach the market without emotional bias. The same result is benchmarked and compared to market returns to compare, identify and improve overall trading activity. The function of OTP dashboard gives a quick reference for the current trades across instruments. The capital allocator function allocates the fund to O/N or term money based on market condition. The platform gives excellent signals when the market is trending.

Manager Pvt Bank

We have been using aialgos trading system as part of our prop trading strategies. We have had a positive experience so far as while generating ideas it brings a certain discipline in our execution. We also use it to supplement other strategies and views that we may be running simultaneously.

Pilot Global Bank

Before starting, I was personally quite disbelieving of the utility of the tool. However on testing it myself, I found this could prove extremely useful in supplementing trader experience and management decision making- purely by virtue of measuring efficacy in terms of output rather than input, and processing information which we may miss on account of our biases and limited information processing capability. Furthermore, the churn (in and out of market) was definitely lower, and even though the package seems overwhelming and complex at first, it becomes fairly simple to navigate once you try understanding the logic behind all the moving parts and get a hang of the GUI. Despite my initial cynicism, I would like to believe that the cost benefit of deploying this tool definitely pays out. Once can see the truth in the numbers.

Trader/Manager – AIF

AIAlgos is a rigorous data analysis engine which efficiently handles inputs to generate signals – irrespective of asset class. This makes it very effective as a multi-strat systematic trading engine. Advantage of AIAlgos over a regular back testing engine is its superior computational capability when it comes to performing vast amount of iterations under multiple permutations & combinations of cycles/periods of the chosen parameters.

Also, we liked the capital allocator model which goes one step further to divide up the capital into different securities (or even asset classes) based on historical assessment of returns. This was unique and not implemented in models we have typically come across.